Wealth Management

Risk and investing are inextricably linked. By diversifying across asset classes, sectors and regions, we try to control risk. To realize a more stable return pattern with a selection of traditional securities (stocks, bonds, and liquidities) we include alternative strategies as part of your investment portfolio. We call these alternative strategies ‘Skills’. The skills include arbitrage funds, multi-strategy funds, and trend-following funds. Historic returns show that investment portfolios composed of stocks and bonds together with alternative strategies provide a higher return at a lower risk compared to an investment portfolio with solely stocks and bond funds. By focussing on risk a positive difference can be achieved, especially in poor investment years.

Finsens was established in 1993. Throughout the years we have built up an extensive network in which a wide range of specialisms are represented. Through our network, we are informed regularly of investment opportunities that we can offer to our clients in addition to market investments, such as real estate participations, corporate bonds, and sustainable investments.

For investments we work together with a third company called OAKK. OAKK is an independent asset manager that offers stable capital accumulation solutions with personal assistance. OAKK’s technologically advanced investment platform is only available to selected financial advisors for a wide range of clients. OAKK Beheerd Beleggen is a trade name of HJCO Capital Partners B.V. (‘HJCO’), a Dutch investment company under the supervision of the Dutch Authority for the Financial Markets (AFM) and DNB (the Dutch Central Bank). HJCO Capital Partners B.V. has operated in the investment industry for over 14 years with more than a quarter of a billion in assets under management.

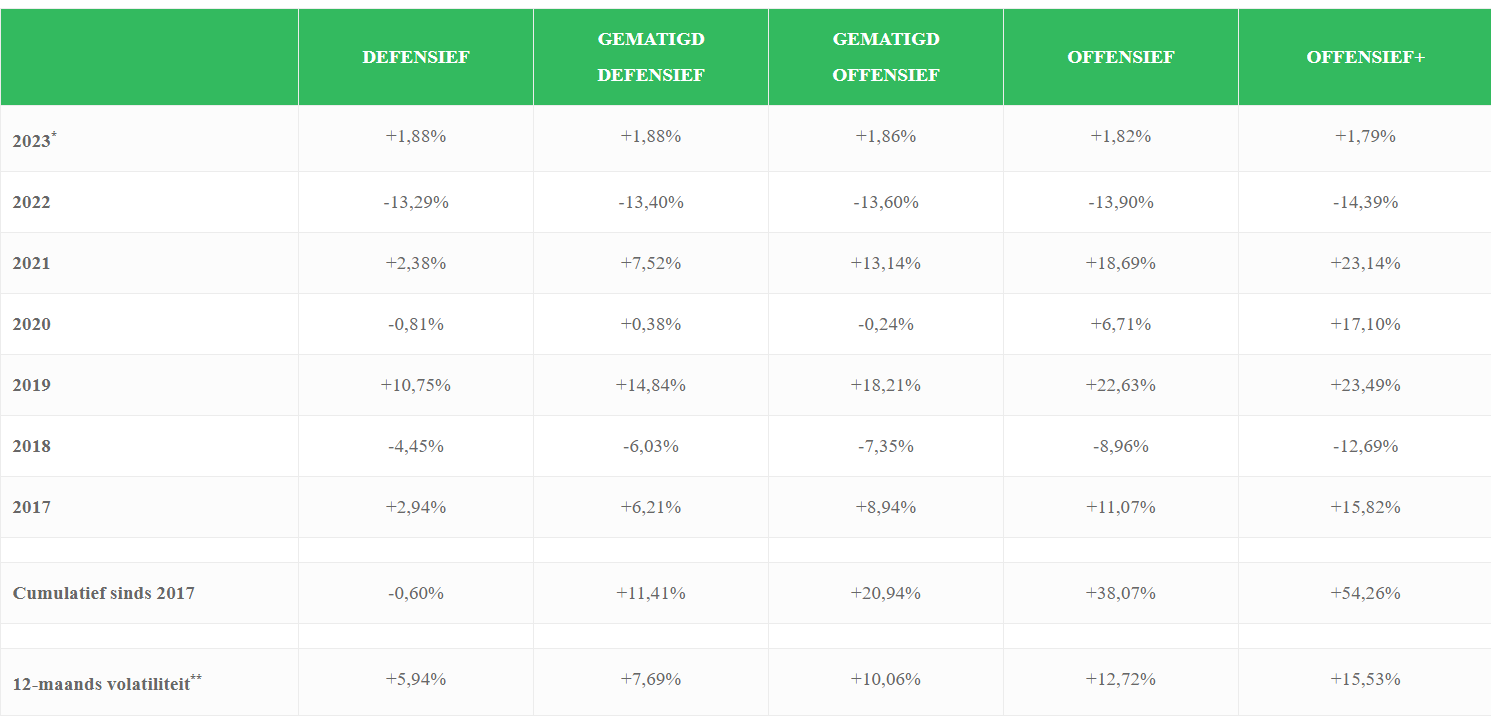

OAKK Profile Performance BVN

Sophie Seesing

Sophie Seesing